Salesforce (CRM) is a cloud-based customer relations service provider situated in the United States. I am bullish on the stock.

Work as We Know It Has Changed Forever

COVID-19's lockdown restrictions have amplified pockets of the digital world that quite frankly could've materialized a lot sooner.

Salesforce's COO, Bret Taylor, summed the future of working circumstances up well by saying, "In this all-digital, work-from-anywhere world, your digital headquarters is more important than your physical headquarters." He also added, "When I think of the metaverse, it's really about people's digital identities becoming as important as their physical identities."

Salesforce facilitates customer and buyer agreements digitally, which I think could cause it to be the ultimate growth company in the business-to-business space in the forthcoming years.

What to Expect from Earnings

Salesforce is set to report its earnings on November 30. The market is generally bullish on the report as Salesforce raised its full-year guidance in September to $26.25-26.35B from $26.2-26.3B.

An interesting aspect for investors to be optimistic about is a few of the firm's deferred items. Salesforce has deferred taxes and receivables worth $2.698 billion and $4.07 billion, respectively. If the company chooses to exercise these benefits in Q4, we could see a significant beat in Salesforce's GAAP reported earnings.

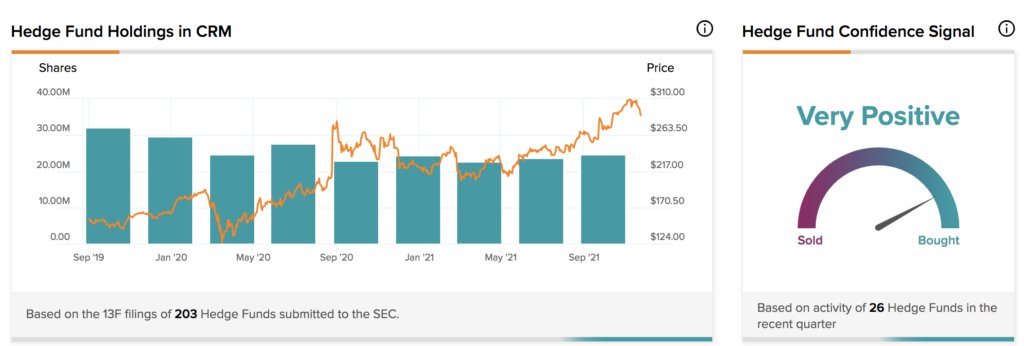

Hedge Fund Flow

According to the latest 13-F filings, hedge funds are bullish on Salesforce stock. During the third quarter, 973.2 thousand shares of Salesforce were gobbled up by hedge funds, with notable investors such as Ray Dalio, Lee Ainslie, and Louis Moore Bacon adding more of the stock to their portfolios.

Wall Street's Take

Turning to Wall Street, Salesforce has a Strong Buy consensus rating, based on 32 Buys and six Holds assigned in the past three months. The average Salesforce price target of $329.25 implies 15.3% upside potential.

Analyst price targets range from a low of $242 per share to a high of $375 per share.

Concluding Thoughts

Salesforce is a beneficiary of the changing work environment. The stock is in excellent shape, and it's possible that the company could smash its Q4 earnings estimate.