CSX Corporation (CSX) offers a very interesting risk and reward investment proposition in the railroad sector. By giving a business overview and analyzing the fundamentals, I argue that CSX is the cheapest railroad stock and, therefore, has to be watched carefully.

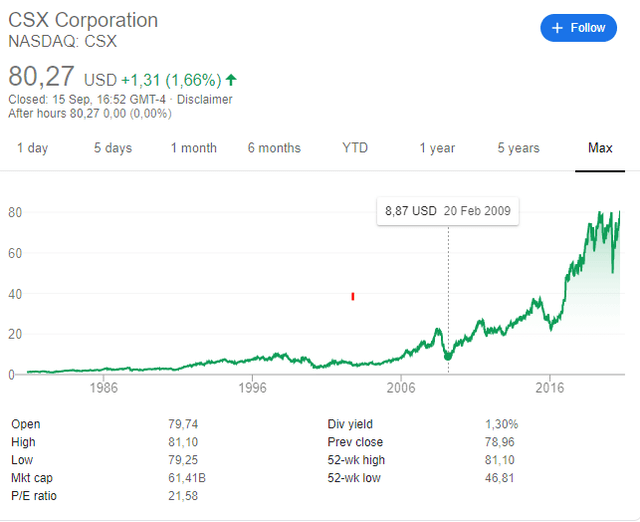

Stock price overview

Long-time CSX investors are very happy with what happened over the last decade given the stock is a 10-bagger, not even including dividends. This shows how prescient Buffett was when buying Burlington Northern in 2009. He got all of his money back already through dividends, as all railroads improved their operating metrics, consolidated and significantly increased cash flows. Let’s see what kind of returns we can expect from investing in CSX railroad stock over the next decade.

CSX stock price historical chart

The market capitalization is $61 billion. Remember the number, as it is key for valuation.

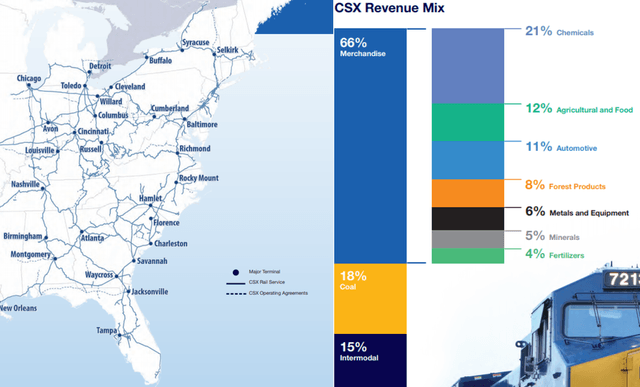

Business overview

CSX owns or operates the following railroads, where it transports mostly merchandise (66%) and coal (18%):

CSX railroad map and revenue mix

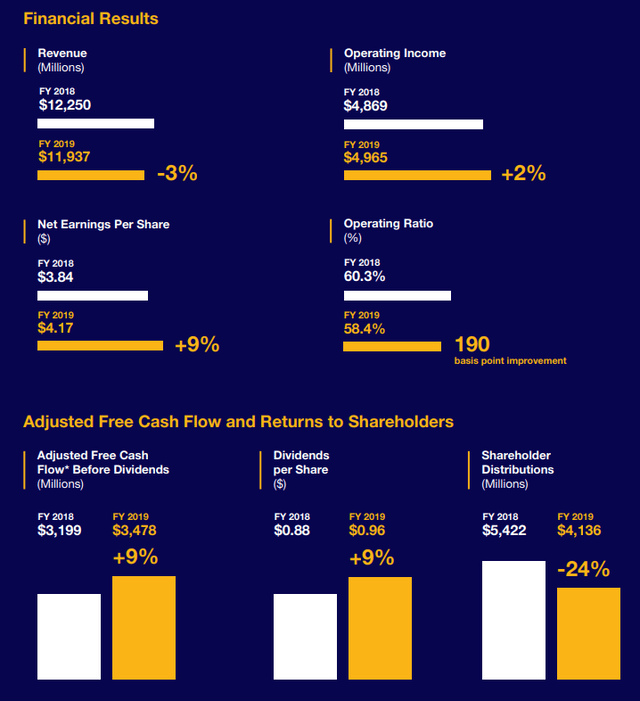

2019 was a good year despite a small decline in revenue. The company managed to improve its operating ratio and lower costs, which led to higher earnings and cash flows.

CSX 2019 financial results

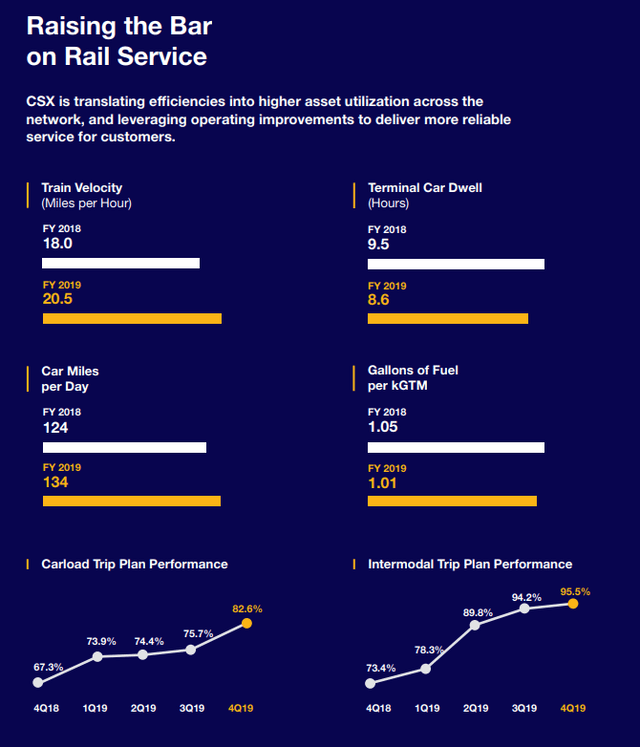

Improving the efficiency of a rail business is key. If management can do that, then the finances follow. CSX has improved on all metrics in 2019.

CSX 2019 operating metrics

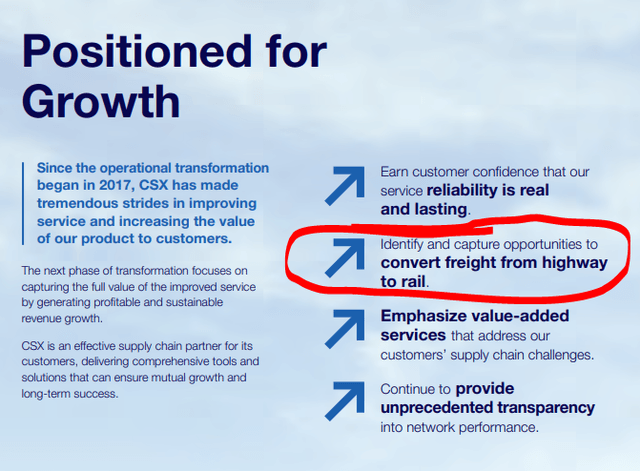

Plus, when you have a railway, the more traffic on it, the more money you make. Thus, for growth opportunities, the company targets highway and other transportation methods given that rail is cheaper and more environmentally friendly.

CSX growth focus

In short, CSX is a very well-operated railroad where the good margins keep it profitable even in difficult times like the current ones.

COVID-19 impact

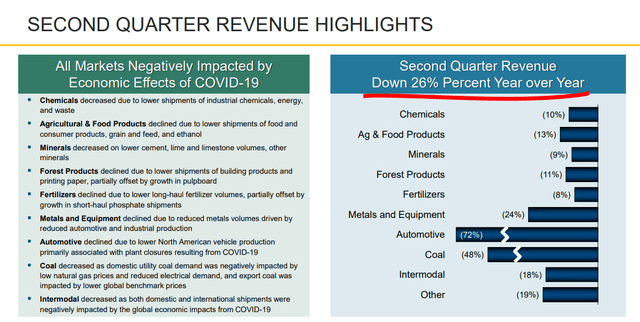

Revenue decreased 26% in Q2 2020, based on a 20% cargo load decline and a 7% revenue per unit decline.

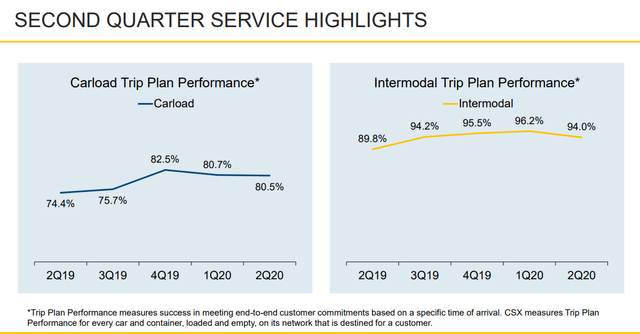

But the company remained efficient and kept its operating metrics strong.

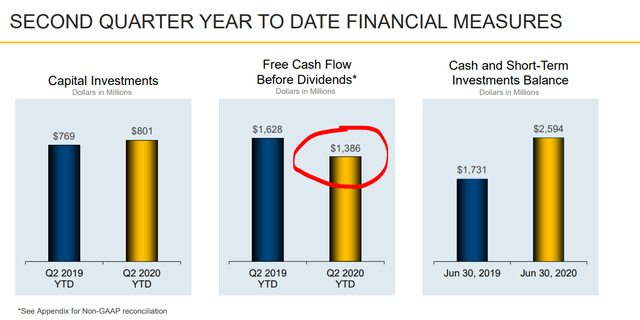

That consequently led to the most important thing: positive cash flows. When you own a railroad, you have something of a moat and fixed costs. When there is enough volume, your margins are high, which is a great benefit in crises, like the current one, because you are still creating positive cash flows.

Given there was just a 20% cargo load decline in the worst economic quarter in history, we can hope a bottom has been reached in May 2020. I would say that the business might return to 2018/2019 levels pretty soon.

To value a company like this, it is best to focus on cash flows available to shareholders. Before valuing the stock, I’ll first discuss the fundamentals and dividend safety/potential.

Stock fundamental analysis

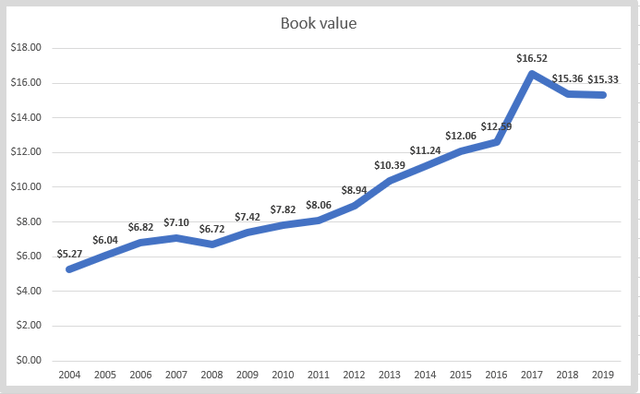

A company that can steadily increase book value over time is usually a great business to own. The price-to-book value now is high and above 5, but in 2009, CSX was trading close to book value. This tells us that we need to look for businesses that provide a margin of safety, can expand margins and, consequently, increase earnings, even in unloved industries like boring railroads.

CSX stock book value

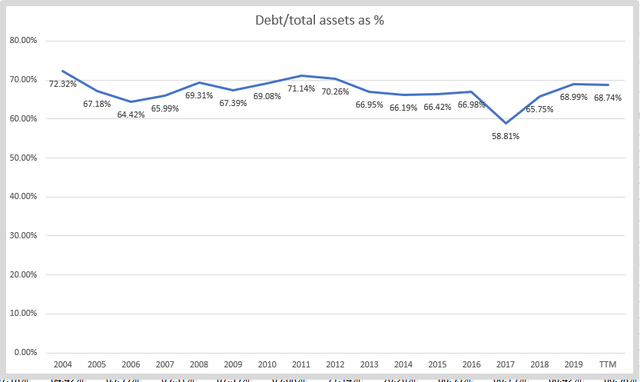

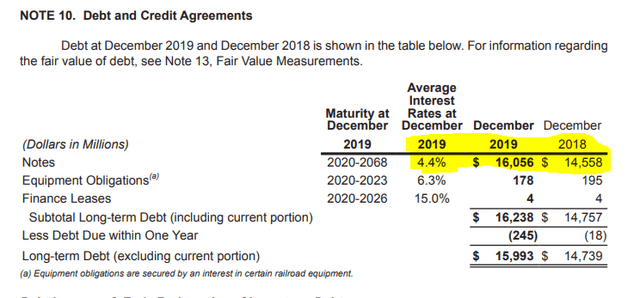

Over the last 10 years, the company has doubled its long-term debt balance from $8 billion to the current $16 billion. However, debt as a percentage of total assets has remained stable over time.

CSX stock analysis – debt level

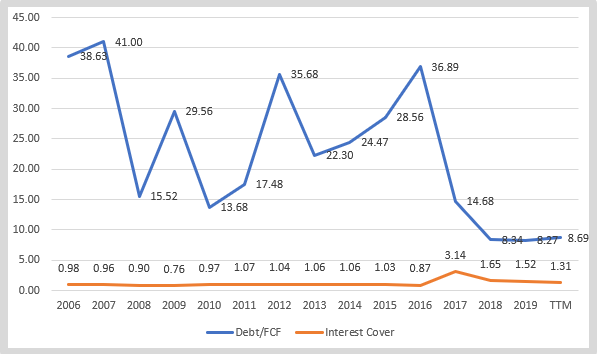

Debt-to-cash flow and interest coverage ratios have actually improved as the cash flows increased over the last years.

CSX stock analysis – debt ratios

Given the moat position this class 1 railroad has, the price advantage it has over other transportation methods, and its high margins, we can hope that debt won’t be an issue over time, so we can focus on the cash flows to make a valuation. Also, it is likely that the dividend will be sustained over time no matter what happens with the economy.

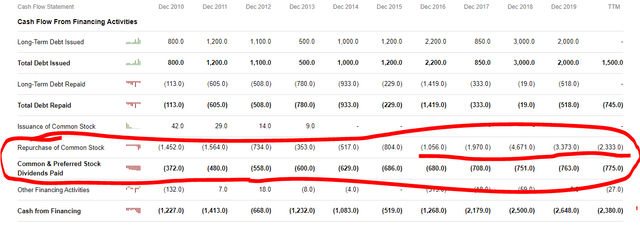

Dividends and buybacks

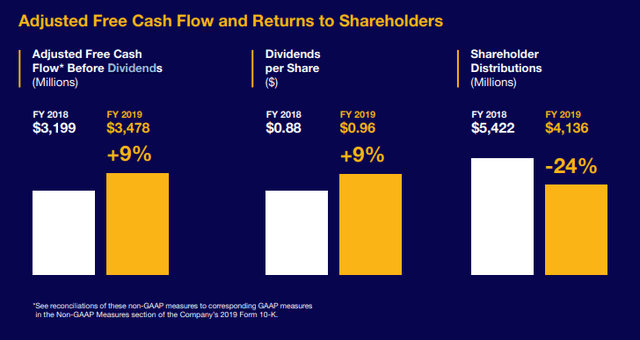

CSX paid a dividend of $0.96 per share in 2019 for a yield of around 1.3%.

CSX stock dividend

1.3% is not much, but the company is making buybacks a priority compared to dividends.

CSX dividend and buybacks spending

Over 2019, CSX has spent the usual amount of $763 million on dividends but a staggering amount of $3.37 billion on buybacks. Over the last 10 years, it has spent $16 billion on buybacks but also increased its debt by $8 billion. We can say that the company is becoming more efficient in its finances and rewarding shareholders, but carrying out buybacks at any stock price is not always the smartest thing to do, in my opinion.

With 2019 free cash flows of $3.4 billion, the FCF yield is still a good 5.5%, so buybacks at current levels should still be value-adding because the company can borrow at an average interest rate of 4.4%. However, the spread isn’t big, and in crises, the cash flow will be much lower. Plus, there is the coal exposure risk.

CSX debt and interest rate

I would say that CSX’s fundamentals indicate a certain degree of risk. The business depends on the economy, and as long as there is enough liquidity to borrow at low interest rates, things will be okay with the stock price. But if interest rates ever go up and there is an economic downturn, the debt pile might become an issue with covenant breaches etc. With debt at 2010 levels, I would consider CSX as low-risk, but given the company is using it to force buybacks, it also increases the risk for long-term investors.

Stock valuation based on FCF

Valuing CSX is pretty easy. In a good year, the company makes $3.4 billion in free cash flow. With a rebounding economy, and hopefully coal demand stability, we can expect cash flows to remain around $3.4 billion, perhaps reaching $4 billion over the long term.

When it comes to valuation, it depends on what kind of return are you happy with from your railway ownership.

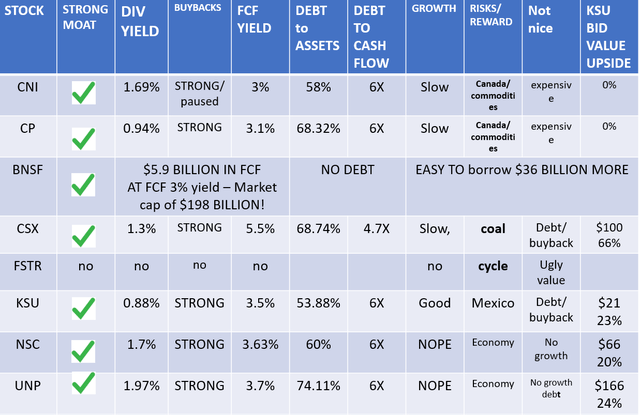

Comparative analysis and investment thesis

CSX actually offers the highest cash flow yield compared to other railroad stocks. It also has the lowest debt-to-free cash flow ratio of 4.7 and not at 6 like all others have. So, if we value CSX at the price of the rejected KSU takeover bid, there is 66% upside for the stock.

Railroad stocks analysis

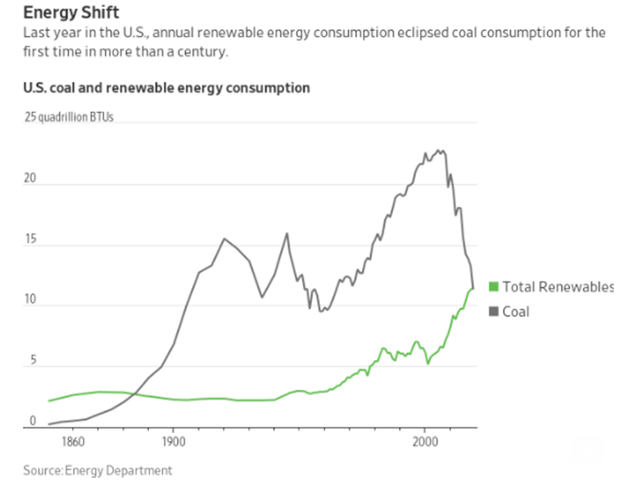

It seems the market is punishing CSX for its coal exposure. I know coal consumption is falling fast, so that is one to watch when considering investing in CSX. Any kind of stability within the coal sector might lead the market to value it like it values other railroad stocks, so watch out for that.

Coal consumption

If you are interested in railroad stocks, CSX is the one to watch carefully, because it offers the highest free cash flow yield. I don’t think coal will go to zero, so the market might value CSX like it does other railroad stocks, and that would lead to significant upside.

The risk is that the market changes its perspective on railroad stocks and requires a higher return. In that case, CSX offers a margin of safety, as the decline would likely be smaller than what would be the case with other railroad stocks.