I recently wrote an article about NVE Corporation (NVEC), its dividend, and its valuation. In the comments, we talked about the possibility of Intel (INTC) entering the same field of semiconductors, which are spintronics. So, I thought it would be interesting to do a comparison of both companies. They are very different, but have some important similarities as well. I will provide insight into the challenges and opportunities of both companies.

About NVE

Before I start, here is an introduction to NVE. I believe Intel is well-known among investors, which can’t be said of NVE.

“NVE Corporation is a leader in the practical commercialization of spintronics, a nanotechnology that relies on electron spin rather than electron charge to acquire, store and transmit information. The company manufactures high-performance spintronic products including sensors and couplers that are used to acquire and transmit data. Products offer smaller size, more precision, higher speed, and are more rugged than conventional devices. NVE parts are popular in industrial, scientific, and medical applications. Sensors acquire information, couplers transmit information, and memories store information. Thus our technology can provide the eyes, nerves, and brains of electronic systems. NVE’s award-winning products are sold through a worldwide distribution network. NVE was founded by Dr. James M. Daughton, a former Honeywell executive, in 1989.”

In essence, NVE Corporation produces spintronics-based products to be used in a wide array of applications. It is already very profitable with its current business. The company’s revenue growth was slow over the past few years. There is still large potential for spintronics. Chips based on spintronics technology use little power and are tiny. They are very useful in many new applications like small medical devices, IoT, factory automation, and next-generation cars.

About Intel

Intel probably doesn’t need much of an introduction. It’s among the largest semiconductor companies in the world. It designs and manufactures chips for data centers and personal computers, but also for cars, the internet of things (IoT), and so on.

We are a world leader in the design and manufacturing of essential products and technologies that power the cloud and an increasingly smart, connected world.

The company has made several acquisitions over the past few years to maintain its technological leadership. The largest acquisition was Mobileye, which focuses on autonomous driving.

Comparison

NVE is a small-cap of about $300 million market cap, and Intel a blue-chip of about $260 billion market cap. If both share prices fluctuate a bit, Intel could be 1000 times the size of NVE. This is obviously where the David vs. Goliath reference comes from. Intel has a broad portfolio of chips and software for many applications. It’s strong in data centers. A lot of growth comes from cloud data centers. The PC-centered business is still about 50% of revenue.

NVE is a much more focused company. It designs products based on spintronics. These products are integrated into industrial, scientific, and medical applications. It doesn’t disclose a lot of customers except for Abbott Laboratories (ABT) and Sonova AG (OTCPK:SONVF, OTCPK:SONVY). It also qualified couplers for NASA’s Europa Clipper mission to one of Jupiter’s moons.

In comparison, Intel has a broad clientele which is a bit less risky than NVE’s. NVE is more dependent on a couple of customers. Intel should be able to keep this broad base, especially as it invests further in new technologies. NVE is also looking for new customers but seems to be struggling more due to its smaller size. The company should get some wins in new applications like in the food safety area it talked about in the Q3 earnings call. Intel did lose an important client in Apple (AAPL) recently. It isn’t clear how much revenue Intel exactly loses. Some estimates put it between 2% and 4% of revenue. Intel should be able to overcome this loss of a customer easily. The PC-centric business is expected to reduce to 30% of revenue, while the data-centric business would increase to 70% of revenue from about 50/50 today.

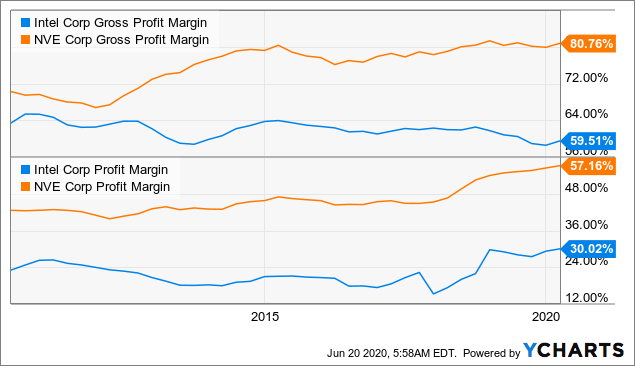

Both companies’ profit margins look good. They have high and expanding profit margins. NVE’s margin is extremely high and could be a sign that it can spend more on marketing. This would improve sales, drive revenue growth, and could in the end boost net profits as well. Intel should be able to maintain these margins while growing revenue.

The nice thing about these high margins is the safety it provides. If their revenue would contract for some reason, NVE and Intel would remain profitable. This is an excellent feature of both companies.

Strong Balance Sheets

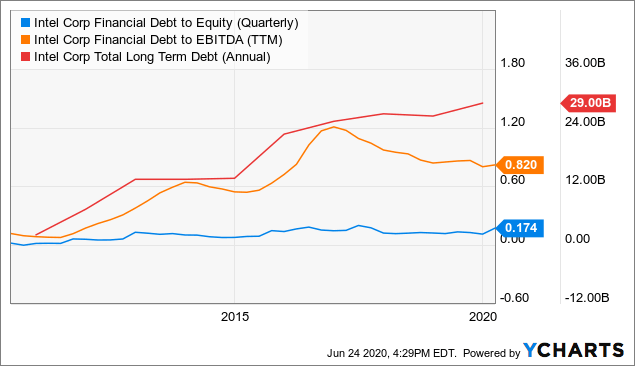

Intel and NVE are very profitable, which makes them more resilient to a recession. The companies should be able to remain profitable at least. There is a difference on the balance sheet though. NVE carries a large net cash position, especially if you include the long-term securities. Intel has a relatively small net debt position of about $20 billion on the balance sheet. It’s less than 1x the EBITDA. This means Intel has room to add more debt if it wants to acquire another company.

I consider both companies financially strong. They are very profitable, don’t have a lot of debt, and should be able to grow revenue and earnings. The greatest risk would be a large acquisition that would add a lot of new debt. NVE hasn’t shown much appetite for acquisitions in the past, and I wouldn’t expect it to do large takeovers in the future. Intel acquired several companies over the past couple of years, but they were all rather small in comparison. These acquisitions increased debt only slightly in comparison to Intel’s earning power.

Return To Shareholders: Dividends And Buybacks

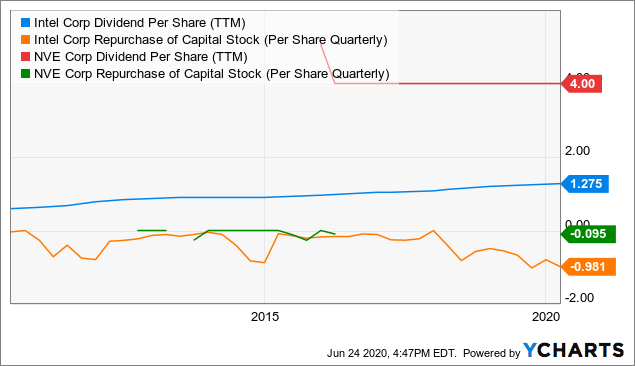

The companies both pay dividends which they can easily maintain. Intel grew its dividend over the past 6 years, and I expect the company to continue to increase it. The payout ratio is about 30% of its net income, and the dividend is covered by the free cash flow. Intel uses the excess free cash flow mainly for buybacks.

NVE is paying out a stable dividend. The company’s dividend is high relative to its net earnings and cash flow. It’s able to do so because of the net cash position it accumulated before paying a dividend. NVE only repurchases shares opportunistically. As shown above, the company didn’t repurchase shares from 2017 until 2019. During the first quarter of 2020, it repurchased during the drop in March and for an average of $52.99 per share – the lowest price in years.

I believe both companies have shareholder-friendly management with a different approach. This is shown by the dividend policies and buybacks. Intel has a better method for the dividend. Shareholders prefer an increasing dividend that is well-covered above a stable dividend. I understand NVE’s desire to reduce cash, I still would have preferred a lower dividend that increases along with better results. NVE is more prudent than Intel with the buybacks – it waits for a low stock price to execute. Intel carries out buybacks whenever it has extra cash.

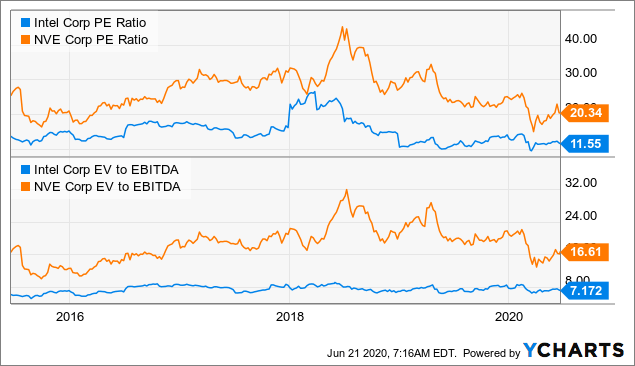

The Valuation Of Intel And NVE

Concerning their 5-year history, both Intel and NVE look valued a bit below average. The reasons are different. Intel is exposed to the global economic outlook. This outlook isn’t bright due to the coronavirus. The company stated in the latest quarter, it expects a slower H2 in 2020. There are also worries that Intel is getting behind its main competitor, Advanced Micro Devices (AMD).

NVE’s below-average valuation is due to the slow revenue evolution. Revenue has been flat over the past couple of years. The company did increase earnings by raising margins, but as shown before, there are limits to maximizing margins.

I include the EV-to-EBITDA because it’s sometimes a more complete metric to compare. EV, or enterprise value, equals the market cap, including the net debt or deducting net cash. The EBITDA is the most comparable because it excludes all one-time write-offs, etc. In the case of Intel and NVE, it shows the same story as the P/E ratio: it’s below past valuations.

I believe these companies are valued rather low. They have proven to be profitable companies and have both strong balance sheets. Intel has proved it can grow revenues and has plenty of possibilities to grow further. NVE has to prove it can grow revenue. It has shown the capability of increasing profitability and earnings. Looking forward, the companies have plenty of opportunities to grow further.

A Look To The Future

I believe it is clear semiconductors will play a large role in the future. A lot of our everyday appliances will have more chips in it than today. Just vehicles alone could use a lot more technology to get to completely autonomously driving. Factories have still a lot of room to add robots, which have chips in them. Everyday household items like vacuum cleaners, lawnmowers, and fridges, cars will all get smarter with chips. Both companies are focused on these new technologies.

Intel has a broad approach to these markets with plenty of new technologies. The company has an impressive marketing machine that pushes its new products to customers. I believe it will maintain its technological leadership. As one of the largest companies in the industry, it is vulnerable to competitors. It’s harder for Intel to gain market share. This is why I like the drive for innovation and acquisitions. It puts a lot of emphasis on the data revolution today.

I’m even more excited about the company’s opportunities in transportation. With the acquisition of Mobileye, it is a leader in advanced driver assistance systems, autonomous vehicles, and crowdsourced maps generating valuable data. This also opens up the market of Mobility-as-a-Service, which is projected to become huge. Several trends of increased safety, environmental awareness, and, most importantly, the ease of use really support the choice for Intel to explore mobility services.

NVE is focused on a couple of interesting segments. The company needs to focus on its advantage of producing small and low-power chips. This makes it easy to see where its opportunities are. Everything that needs to be small and low on power consumption is an opportunity for NVE. Medical devices are already a key segment and will remain interesting for obvious reasons. They need to be small, are often expensive, and don’t have access to a large power source. The IoT revolution supplies plenty of these opportunities.

I believe in all other segments the company mentions (factory automation, next-generation cars, IoT), these small and low-power chips offer an advantage. It seems it’s only a matter of time before NVE can exploit this advantage and tap more revenue from these segments.

Conclusion

If you would take a look at the Investor Relations website of NVE and compare it with Intel’s, they differ like day from night. Intel has a state-of-the-art website with several investor tools and pretty nice online yearly reports. NVE’s website doesn’t look a bit flashy and doesn’t have impressive PowerPoint presentations. This is, of course, the difference in market cap but also the difference in cost control. NVE won’t spend a dime if it doesn’t need to. Intel is prepared to spend money with uncertain returns.

Both companies maintain shareholder-friendly returns with a combination of dividends and buybacks. NVE is paying out a very high steady dividend to return buildup cash. The company has a buyback program that it uses opportunistically, and it recently repurchased shares when the price dropped. Intel is paying out a growing dividend. This is more than covered by earnings and cash flow. The company uses excess cash flow for buybacks.

I like both companies. They are active in a growing industry with a lot of runway left. New technologies offer many opportunities for semiconductor companies. Intel will be challenged by NVE and many other companies that want to take a piece of the pie. NVE has to fight against the marketing machines of larger competitors such as Intel.