Investment Thesis

Big Lots, Inc. (BIG) is a discount retailer with over 1,400 stores in 47 states of America. Like TJX Companies (TJX), Ross Stores (ROST), and Five Below (FIVE), BIG's business model is to buy various wholesale goods in order to create a "treasure hunt" experience for customers in stores. Unlike other discount retailers, BIG's store count has hardly budged over the last decade. Its revenue has only risen 12% since Q4 2009, and net income has fallen in that time period.

While I wanted to like BIG because of its juicy 5.56% dividend yield and ostensible cheapness, I instead came to the conclusion that the stock is cheap for a good reason and that the dividend is unsafe. The bargain-basement valuation is certainly tempting and could provide a good entry point for a speculative turnaround play, but I'm passing on BIG for now.

The Long-Term Performance In One Chart

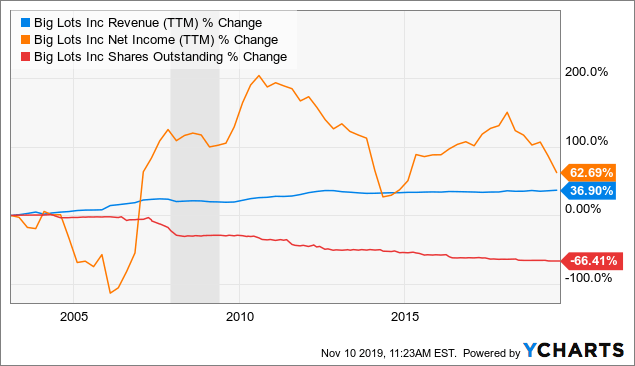

By the beginning of 2003, BIG had completed a nationwide conversion of its multiple store brands into the single "Big Lots" brand. So let's look at how BIG has performed as a company since then:

As we can see, despite significant share repurchases (which have been artificially boosting EPS into positive territory), net income has been weak-to-declining over the past decade, while revenue growth has been minimal.

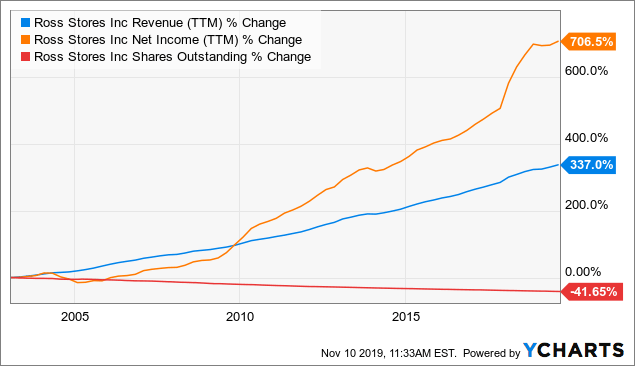

In case you think that slow growth and profitability is just a challenge for all companies operating this business model, check out the same metrics for discount retail rival Ross Stores over the same time period:

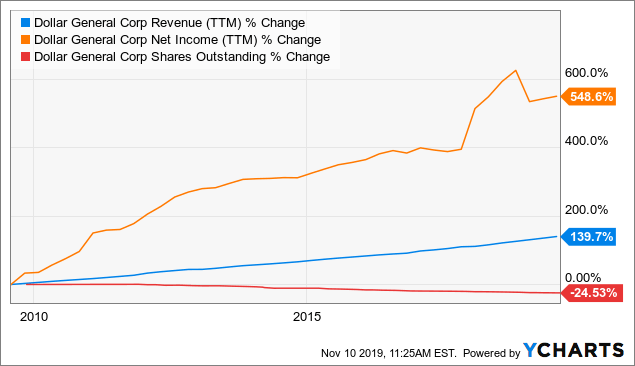

ROST has repurchased fewer shares as a percentage of its 2003 base while achieving much stronger revenue and net income growth. The same could be said for dollar store brand Dollar General (DG):

BIG's lackluster performance really comes down to same-store sales. Comparable store sales growth, while mostly positive over the last decade, has not been stellar:

- 2007: 2.0%

- 2008: 0.5%

- 2009: 0.7%

- 2010: 2.5%

- 2011: 0.1%

- 2012: -2.7%

- 2013: -2.7%

- 2014: 1.8%

- 2015: 1.8%

- 2016: 0.9%

- 2017: 0.4%

- 2018: 1.2%

- 2019 YTD: 1.35%

From 2007 through 2018, then, same-store sales growth averaged only 0.54% per year. Add to this the fact that BIG's store count is, on net, practically unchanged since 2010. No amount of buybacks can fix weak same-store sales growth and overall lack of robust revenue growth.

Valuation

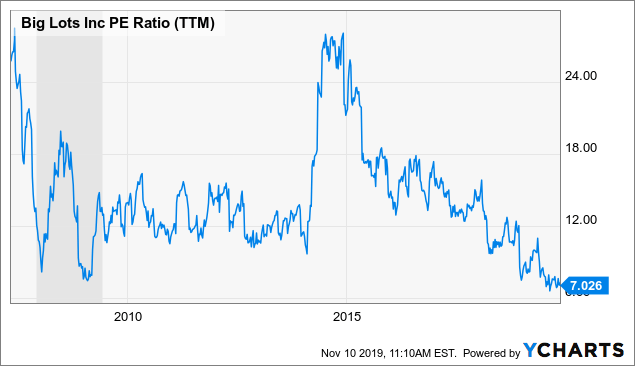

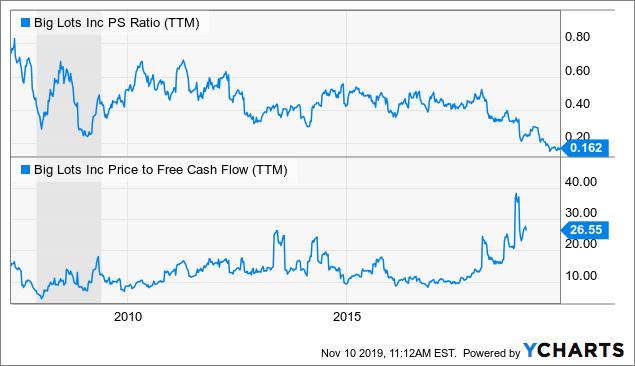

When it comes to valuation, however, the picture is a bit more bullish, as the stock is trading cheaper than it has ever been by several metrics. Trailing price-to-earnings, for instance, is lower than it was during the depths of the Great Recession, during which BIG's stock shed half its value.

We find the same picture when we pit price against sales, which have been slowly growing while the price falls.

Free cash flow (second panel above), however, has come under intense pressure in recent years as the company has cycled through a few different CEOs and turnaround plans with all of the added investment that has come with. This increased capex has not yet translated into noticeably increased sales numbers. During a time when the American consumer is financially healthy, enjoying rising wages, and happily spending, BIG doesn't seem to be capturing much more of this spending than it usually does. And it is converting even less of the American spending it is capturing into FCF.

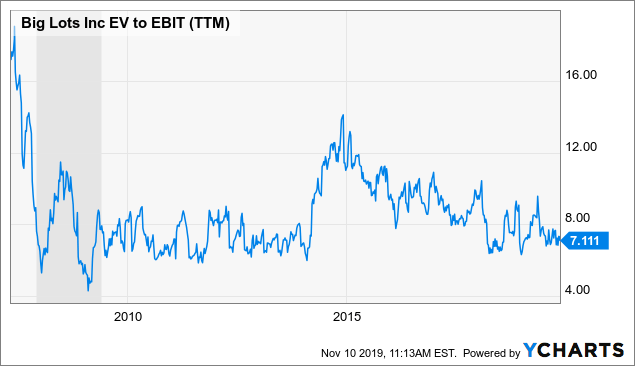

Looking at enterprise value (which measure the total value of the business, including debt) against EBIT (a rough measurement of operating earnings), we find that the stock is quite cheap, though not to the extent reached during and after the Great Recession.

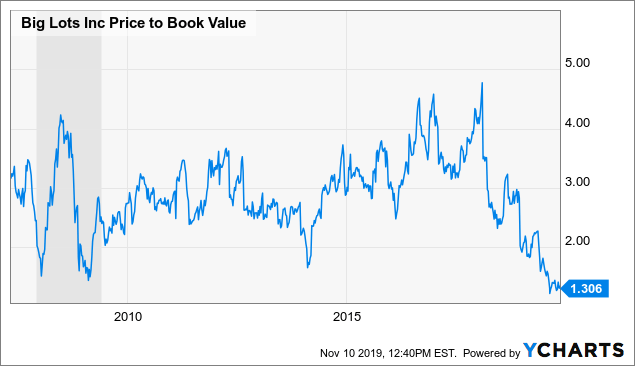

Finally, looking at price to book value, we find that the market is valuing BIG only 30% more than the business's liquidation value. Once again, this is even cheaper than the lows reached during the Great Recession.

This at a time when the S&P 500 (SPY) is trading at around 3.5x book value.

The Dividend

BIG pays out $0.30 per share per quarter but unfortunately earned only $0.16 per share of net income in the latest quarter. In the past two quarters, it has earned $0.55 while paying out $0.60 in dividends. Now, the primary reason for this steep dive in earnings from prior quarters is the company's "strategic business transformation" which includes new management and an updated store format (remodels). If not for these transformation efforts, the EPS would have been $0.53, thus covering the dividend but still down from the same quarter in 2018's $0.59 EPS.

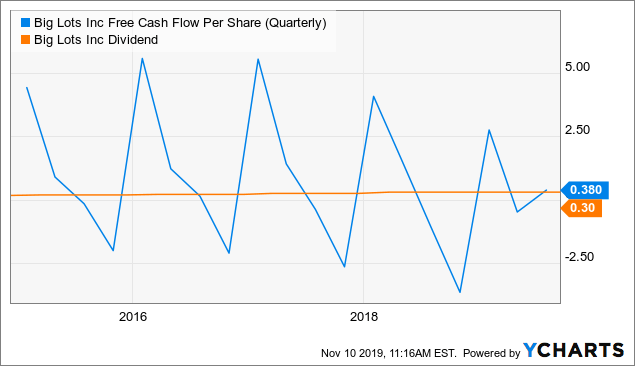

Looking at free cash flow, which subtracts debt service payments but adds in other non-operating income, we find similarly poor setup. Since beginning to pay a dividend in the second half of 2014, FCF coverage of the dividend has been slowly eroding.

FCF amply covered the dividend until about mid-2018, then slid down rapidly. Now, it appears as though BIG would be lucky to even end the year with positive FCF. Dividends as a percentage of operating cash flow have doubled from 11% in 2015 to 22% in 2018, leaving less and less capacity for capital expenditures and fixed charge payments without issuing debt.

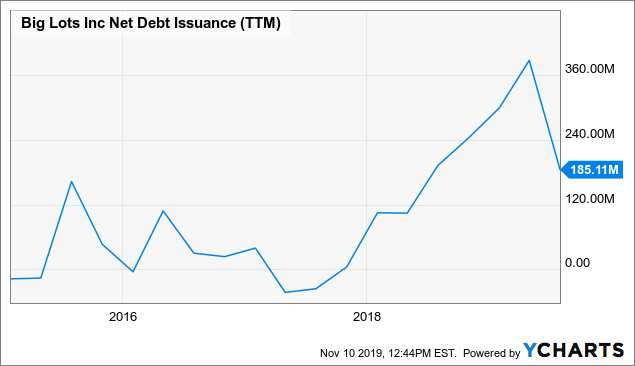

In fact, that's exactly what we've seen in recent years as cash flow isn't high enough to cover the dividend, the mostly ill-timed buybacks, and the necessary capex for the turnaround play.

This increasingly squeezes the fixed charge coverage, necessitating more debt issuance in order to carry out further capex. For now, net debt to EBITDA is still low at 0.99x, but that will likely grow over time.

Of course, management always has a "plan" to get back to profitability and FCF coverage of the dividend. For BIG, that includes remodeling its stores, building out an omni-channel system, expanding into old Toys "R" Us locations, and putting furniture front and center while food and other small merchandise goes to the sides and back of the store.

Conclusion

Nobody likes to hear bearish takes on businesses they own and like. As stated previously, I began my analysis of BIG wanting to like it. I was attracted to that high dividend yield as well as its annual growth since being introduced in 2014. But, at the end of the day, the dividend payout has to come from somewhere (preferably free cash flow). When the company is not generating enough cash to cover the dividend, buybacks, capital expenditures, and fixed charge expenses, something's got to give. Issuing more debt to cover the shortfall is a temporary solution, at best.

At a time when unemployment is at record lows, wage growth is rising, and the American consumer is spending, BIG has struggled. The company simply has not been able to meaningfully expand its market share. Its store count has, on net, declined for years since its post-recession peak. Competition from the likes of TJX, Ross, Five Below, and various dollar stores seems to have gotten the best of BIG. It has little to no moat (i.e., competitive advantage), and the analyst consensus is for earnings to contract by 0.75% per year over the next five years.

But, on the other hand, the market seems to have priced all of this in already. By several metrics, the stock is cheaper than during the Great Recession. Today, you can buy BIG for 7x trailing twelve-month EPS, which is an indication that the market expects zero growth for a long while. The question is: Will there be growth eventually? Will the turnaround play work?

If you have hope that the turnaround play will make a significant difference, the stock looks like a solid buy here. But one could also view this "turnaround play" as what was necessary in today's competitive climate to maintain any growth at all. In retail, almost everyone is going to omni-channel. Lots of discount retailers are updating their stores, adding more refrigerated grocery space, and rolling out loyalty programs and/or smartphone apps.

Personally, I don't see anything special about BIG as a business except its valuation. It's a fair (at best) company at a wonderful price. In some cases, that would be enough to make me pull the buy trigger. But in this case, I don't have confidence in the safety of the dividend going forward, much less in its growth, and as such, all of my interest in BIG has dissipated.