Inflation continues to rear its ugly head, with the consumer price index rising 7% in December. The consumer price index was up 0.5% on a monthly basis, but there is no question that consumers are feeling the pinch of higher costs for a variety of things, including food at the grocery store and gas at the pump.

Inflation can also eat away at the investor’s hard-earned retirement portfolio. For dividend growth investors, this can mean that the income produced is no longer as valuable as it was. This group of investors may need to see their dividends grow at a higher rate than inflation in order to cover there expenses.

The good news is that there are stocks providing inflation-beating dividend increases, implying long-term business and dividend sustainability. This article will look at three such companies that recently raised their dividends at a higher rate than what the inflation reading was for last month.

Ally Financial

The first name on this list is Ally Financial Inc. (ALLY, Financial), which specializes in providing financial services to consumers and automotive dealers. The company provides inventory insurance, term loans and new and used vehicle inventory financing, among other policies. Ally Financial has a market capitalization of $17.5 billion and sees $6.7 billion of annual revenue.

Ally Financial raised its dividend 20% for the Feb. 15 payment date, the company’s largest raise since 2017. The new annualized dividend is nearly eight times what it was in 2016.

Shares of the company yield 2.3% today, topping the average yield of the S&P 500 Index by 100 basis points. The current yield is also above the stock’s five-year average yield of 2.2%, according to Value Line.

The stock trades at just 6.2 times Wall Street analysts' earnings estimates for 2021 and 7.2 times their estimates for 2022. Ally Financial had an average price-earnings ratio of 8.2 over the past five years.

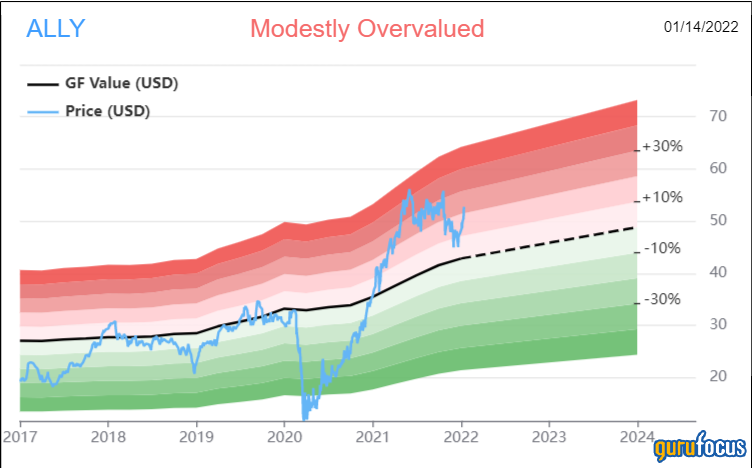

The GuruFocus Value chart shows that the stock is ahead of its intrinsic value:

With a share price of $52.76 and a GF Value of $42.94, Ally Financial has a price-to-GF-Value ratio of 1.23. Shares are rated as modestly overvalued.

Jefferies

The second stock on this list is Jefferies Financial Group Inc. (JEF, Financial), a diversified financial services company. The company offers investment banking, capital markets, commercial mortgages and asset management services, among others. Jefferies is valued at $10.2 billion and has annual revenue of $10.7 billion.

The company raised its dividend by 20% for the Feb. 25 distribution date. Jefferies’s new annualized dividend is nearly triple what it was five years ago. The stock offers a yield of 3.2% at the moment, almost twice that of the 10-year average yield of 1.7%.

Jefferies trades at 10.1 times last year’s earnings estimates and 9.1 times this year’s estimates. The last half decade has seen the stock undergo some severe swings in the price-earnings ratio, from a low of 6.8 for 2020 to a high of 29.4 for 2018 for an average of 16.7 over this period of time.

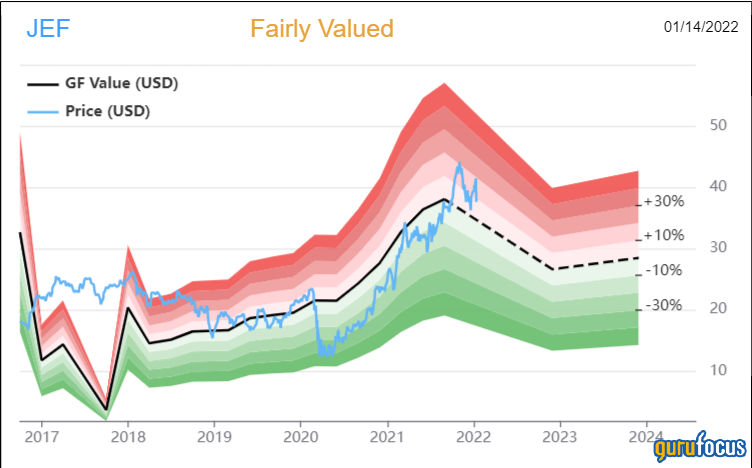

That said, the stock is trading somewhat close to its intrinsic value, according to the GF Value chart:

Lakeland Financial

The last name for consideration is Lakeland Financial Corporation (LKFN, Financial), a holding company for Lake City Bank. The company provides financial services, such as deposits, checking, savings and money market accounts. Lakeland Financial also provides agricultural, commercial, industrial and real estate loans. The $2.1 billion company generates revenue of $212 million per year.

Shareholders will see their dividend payment increase by 17.7% for the Feb. 7 payment date. No stranger to high growth rates, the company’s dividend has more than doubled over the last five years.

Lakeland Financial’s new annualized dividend gives the stock a yield of 1.9%, below the medium-term average of 2.3%, but still above what the market is paying.

Using analysts' consensus estimates, shares of Lakeland Financial have price-earnings ratios of 22.6 of 23.7, respectively, for 2021 and 2022. This is well above the stock’s five-year average earnings multiple of 15.9.

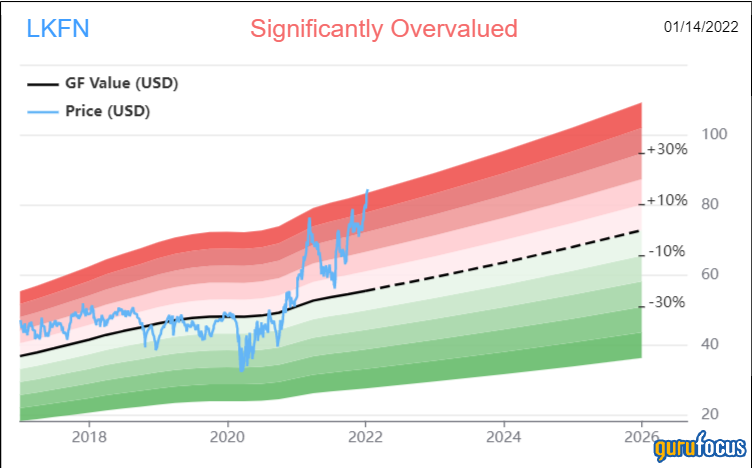

The GuruFocus Value Chart also shows the stock to be trading with a rich valuation.

Lakeland Financial trades at $84.51 today. With a GF Value of $55.69, the stock has a price-to-GF-Value ratio of 1.52. As a result, Lakeland Financial has a rating of significantly overvalued.

Final thoughts

Inflation has been at the forefront of the economic picture for some time now, with the latest reading showing a 7% climb in the CPI. While much of the focus is on the current price of gas and groceries, inflation can eat away at one’s retirement nest egg and, for dividend growth investors, the income stream.

Fortunately, stocks like Ally Financial, Jefferies and Lakeland Financial have announced dividends raises that are above the rate of inflation. This suggests that these names might be attractive to investors looking for ways to counteract the impact of inflation on their dividend income.